What can Bitcoin do for the stock market of Chile? Bitcoin doesn’t have country borders, meaning Chilean investors can buy it on international exchanges. As a digital currency, it can increase transparency. Anyone can view past transactions, so it can boost market confidence. This article will examine these implications. Read on to learn more about the impact of Bitcoin on the Chilean stock market. Let’s start with some basic concepts.

Positive

The introduction of Bitcoin in Chile will likely have some positive effects on the stock market. The popular cryptocurrency is an excellent way to make stock transactions faster and more transparent. It is also capped at 21 million coins, which will limit the chances of inflation. Furthermore, Bitcoin will give investors more choices in terms of investing and trading, leading to more confidence in the Chilean stock market. However, the stock market in Chile isn’t quite ready for Bitcoin just yet. Its adoption is still far from complete.

Model 3 isolates asymmetric effects caused by Bitcoin. It uses the S&P500 as a control variable, which drives significant activity in the currency markets of Latin America. This allows researchers to identify the enormous influence of US investor behavior on Latin American currencies. This paper has not modeled the negative effects of Bitcoin, but we do have some insights from this experiment. The results of Model 3 will be released in a couple of weeks.

As with the S&P 500, cryptocurrency prices are heavily influenced by political decisions between countries. These actions, such as trade restrictions, may affect the supply of materials, labor forces, and shipping. Therefore, investors in such assets fear that they might face price instability and volatility, and will buy or sell accordingly. We are not advocating the use of crypto-assets as currency, but we urge investors to take our advice.

The study also found

The study also found that the Argentinean peso does not respond as strongly to the S&P500 index as the Peruvian sol. In addition, the currencies of Colombia, Mexico, and Chile have very significant sensitivity to a rise in the S&P500 index. As a result, the Argentinean peso and Peruvian sol are correlated in the stock market of Chile.

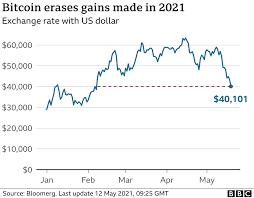

The recent crash in the cryptocurrency market has caused a large amount of panic among investors. The S&P 500 fell nearly one-hundred points, and the economy slowed to a crawl. The recovery, however, has gotten underway. With Bitcoin’s price increase, Chile’s stock market could be in for a huge boom. However, the volatility in the digital currency is still a concern, and it may be unwise to invest in it.

Negative

According to recent statistics, the global network of bitcoin miners uses more energy than the country of Chile, which could lead to significant carbon emissions. For instance, one plant in Greenidge, Chile, houses 8,000 computers, but plans to add more, which would require more natural gas to produce energy. Meanwhile, Chile’s private equity sector has increased rapidly over the past few years, with many companies acquiring debt in order to sell at a later time for a profit. Private equity firms are notoriously secretive, and their influence on the economy has been growing considerably in recent years. The number of private equity firms is now over five trillion, and their portfolios include nearly half of all the country’s pension funds.

Uncertainty

Citigroup analysts are cautious on Chile’s stock market, with growing calls for a new constitution causing uncertainties about the extent of changes to the country’s constitution. While the protests have not affected all markets equally, they have led to increased economic risks. During the 2008-2009 economic crisis, policy uncertainty intensified, as reflected in a recent study by Baker et al.

To measure the economic policy uncertainty of Chile, researchers studied the correlation patterns of financial stocks, including bitcoin, with the SandP 500 index. They also assessed the impact of policy uncertainty on Bitcoin volatility and risk premium, comparing the correlation between the two assets. Overall, the researchers found that there was a positive correlation between the two cryptocurrencies in a bear market and a negative correlation during bull markets.

The cryptocurrency market can be a safe-haven for investors. Cryptocurrency trading is usually based on market sentiment and information, and it acts as an insurance against economic policy uncertainty. However, investors should know where to hedge their economic policy risk. As a result, they should invest in countries with stable governments and a stable economic climate. While the cryptocurrency market can act as a safe haven, investors should be cautious when using the market for investment.

Similarly, researchers have examined the impact of economic policy uncertainty on the top four cryptocurrencies. Using Granger Causality and Ordinary Least Square methods, Wu et al. found a significant causality between EPU and Bitcoin. As for the correlation between EPU and economic policy uncertainty, Mokni et al. found a positive relationship between EPU and Bitcoin returns.

Liquidity

The introduction of Bitcoin to Chile’s stock market could have profound implications for the market. This is because Bitcoin transactions are processed directly between peers and do not involve a third-party intermediary. Furthermore, there is less risk of fraud and theft, and the speed with which transactions are completed is faster than traditional methods. This could increase confidence in the Chilean stock market and help boost its liquidity. Nevertheless, the potential impact of Bitcoin on the Chilean stock market should be carefully studied.

The current unique circumstances of Chile provide a fertile ground for studying how liquidity changes in response to different government interventions during periods of crises. A study that examines how this process works in Chile would be highly useful for cryptocurrency investors. In addition, Chile’s central bank is taking measures to improve liquidity on the foreign exchange market in Chile. Such measures could help Chile’s economy cope with a variety of external and internal risks, including geopolitical risk from Argentina. Furthermore, Chile’s domestic unrest has recently come to a head. On top of all that, in 2020 Chileans will vote for a new constitution that will grant more power to the government to administer social services.

Earlier studies have concentrated on the impact of government interventions on the market’s liquidity. But this study focuses on a fundamental feature of global markets – liquidity. This paper identifies the features of market liquidity programs and summarizes their evaluations. Additionally, it identifies the general resources for market liquidity. The study’s results can inform policy makers and investors alike. And it will also help investors understand the effects of government intervention on liquidity.

In terms of price, Bitcoin’s liquidity is one of the most important factors determining its value. The price of Bitcoin can change drastically in just a few minutes. While other assets such as gold or other assets have higher market cap and a higher daily trading volume, they have a limit to how much they can fluctuate in value. By reducing this limitation, Bitcoin could become more attractive to investors and rise in price.

+ There are no comments

Add yours